Even though e-commerce continues to grow, rising customer expectations, cost pressure, and labour shortages are driving the need for greater efficiency. Parcel services, as well as companies in many other sectors are therefore increasingly investing in fulfilment services and automated warehouses. This is where efficiency in logistics begins. At the same time, the global market for warehouse automation is expected to grow rapidly – from over 25 billion US dollars today to over 54 billion in 2029. So are fulfilment and automation the logical evolution of traditional parcel logistics?

The warehouses of this world are the last sleeping giants. The receipt of goods, their storage, picking, packaging, and shipping, as well as returns processing – in short: fulfilment – are often still accompanied by many manual processes. While parcel centres are already highly automated, warehousing and fulfilment operations hold unimagined potential for process optimisation.

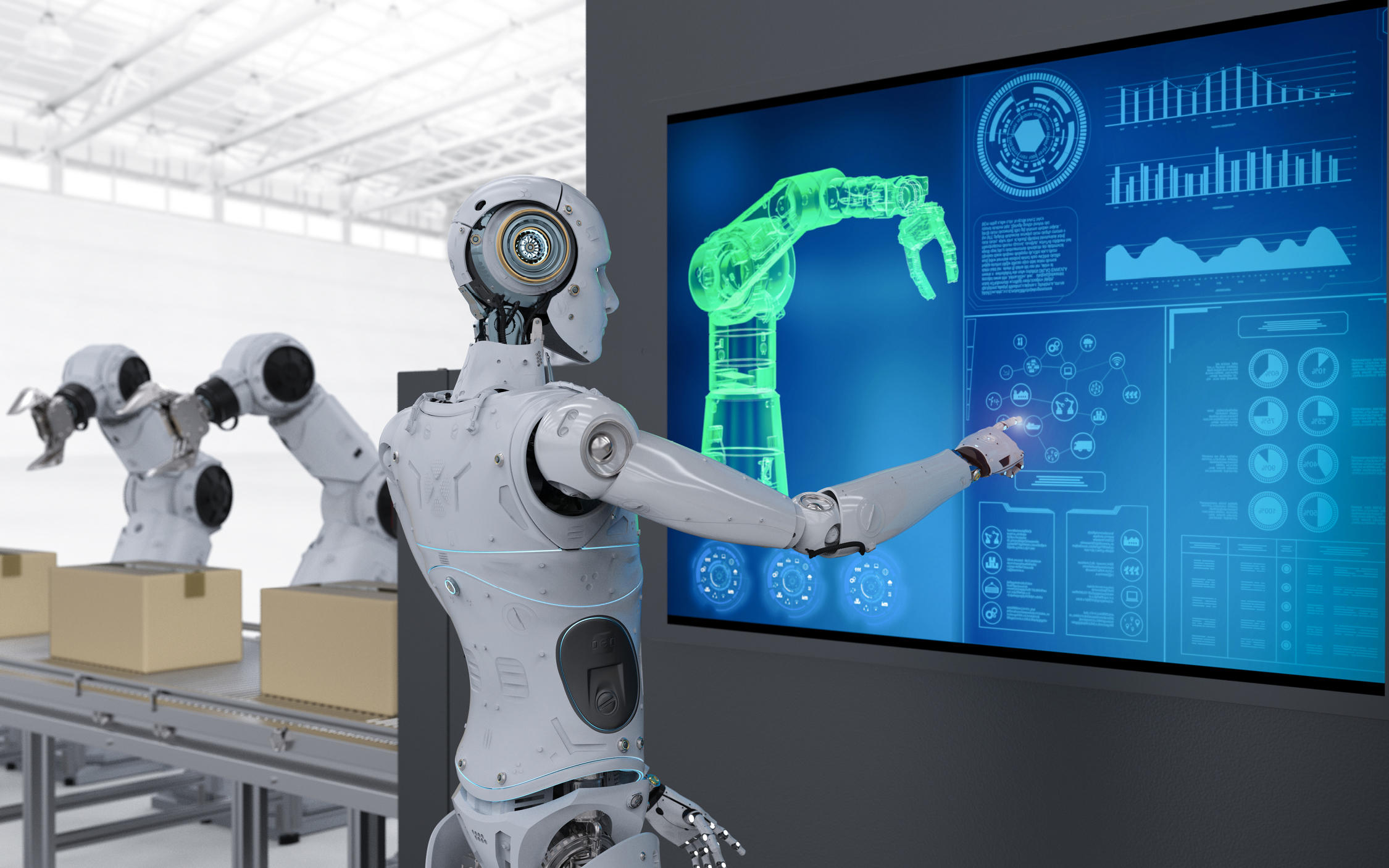

Critical success factor: automation and AI

Technological solutions are already being used successfully: conveyor systems and sorting systems ensure a smooth flow of goods. Robots pick items, pack shipments or palletise goods – sometimes hand in hand with humans. Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) navigate warehouses independently, flexibly handling transport tasks around the clock.

Particularly efficient are automated storage systems like AutoStore or shuttle solutions, which store thousands of items in a minimal space and make them available in fractions of a second. These systems are controlled by intelligent software that analyses, prioritises, and optimises warehouse processes in real time.

Automation is also playing an increasingly important role in packaging. On-demand packaging systems not only save material but also shipping costs. Many of these solutions are supplemented by AI-supported image processing and sensor technology that recognise errors and continuously improve processes.

The result: faster throughput times, fewer errors, greater scalability – and warehouse logistics that are ready for the demands of tomorrow. Automation, combined with modern IT and AI, is becoming the critical success factor.

Online retail is a pioneer

E-commerce has long understood this and is far ahead in the use of automation and AI: in April 2022, Amazon launched the Amazon Industrial Innovation Fund (AIIF), a funding programme worth one billion US dollars. Amazon operates the most modern automated warehouse in Shreveport, Louisiana. This state-of-the-art fulfilment centre covers an area of around 280,000 square metres and integrates robotics and artificial intelligence into almost every step of the fulfilment process. Shreveport serves as a model for Amazon’s future automated warehouses around the world.

In Germany, for example, the online retailer operates 23 logistics centres. The company opened its largest logistics centre in Erfurt in 2024. More than 26 million products can be stored here. Approximately 3,600 transport robots and 15.4 kilometres of conveyor belts ensure that the goods from 80,000 shelves reach the employees and can then be packed. In terms of robot deployment, this logistics centre is the most advanced in Europe.

Parcel services increasingly rely on fulfilment

More and more logistics and parcel service providers are also entering the fulfilment sector: DHL, Hermes, DPD, and GLS are increasingly investing in AI, automation, and robotics – offering their own fulfilment solutions including warehousing, picking, packing, and, of course, shipping.

DHL Fulfillment, for example, opened a fully automated robotic fulfilment centre in Staufenberg, Germany, in 2023. The core of this facility is a 6,000 square metre AutoStore system. 16-level high aluminium grid stores 196,000 containers on the surface of which 160 robots pick goods fully automatically. Employees at 21 ports handle further processing and dispatch preparation.

GLS Group, on the other hand, acquired Versandmanufaktur GmbH in 2023, a company specialising in e-commerce fulfilment for SMEs. Its fulfilment centre has implemented an automation solution with 14,000 storage locations, 64 robots, and eight packing stations to optimise fulfilment processes and meet the increasing demands of e-commerce.

Hermes Fulfillment, part of the Otto Group, has been using the Stretch unloading robot from Boston Dynamics in Haldensleben, Germany, since 2023. This robot autonomously unloads parcels weighing up to 23 kilograms at a rate of 500 per hour.

Parcel logistics companies see fulfilment as the perfect opportunity to get deeper into the value chain. The idea behind it: those who offer warehousing, technology, and delivery from a single source are faster, more efficient – and the ideal partner for many e-commerce providers in an increasingly automated retail world. This opens up new sources of revenue, especially with small and medium-sized online retailers looking to outsource their logistics. Parcel services are transforming into logistics platforms with their own fulfilment solutions.

High investment costs and complex integration

Whether this approach will be successful is a question of financial and human resources – and the strategic direction of the company.

Automated warehouse systems require significant initial investment for hardware, software, integration, and training. Amortisation often takes several years. Additionally, many warehouses, where they already exist, operate with grown, often heterogeneous IT systems, and manual processes. The introduction of automated systems requires far-reaching interventions in processes, IT, and possibly the building structure.

Moreover, the planning, operation, and maintenance of automated systems need qualified personnel, both on the technical and IT side. However, the shortage of skilled labour makes it difficult for many companies to introduce and operate these systems efficiently.

From operational processes to customers and customer acquisition to expertise, warehousing is fundamentally different from parcel logistics. Whether it is worth the effort to ensure improved access to the e-commerce market with additional fulfilment services must be strategically weighed.

Weigh up business risks – especially in volatile times

It is a fact that e-commerce is growing unabated and with it the demand for speed, scalability, and transparency in logistics. This makes warehouse automation all the more important. In 2024, North America held the largest market share here. Europe is already catching up. However, the Asia-Pacific region is estimated to have the highest growth in this segment during the forecast period from 2024 to 2029.

Automated warehousing is particularly beneficial for companies with high throughput volumes, 24/7 operations, and low seasonal fluctuations. It can significantly improve efficiency and competitiveness, especially in sectors such as e-commerce, the automotive industry, and food retail, where the demands on delivery times and inventory accuracy are high.

Setting up fulfilment solutions alongside parcel services can be a rewarding and interesting business strategy. However, fulfilment and automated warehousing solutions traditionally belong to the contract logistics sector and have little to do with traditional parcel logistics. The business segment must therefore be strategically intended – and sufficient financial and human resources are a prerequisite for pushing ahead with its establishment and further development. This is not an issue for internationally operating logistics groups: their business lines not only coexist – they also fertilise each other.